|

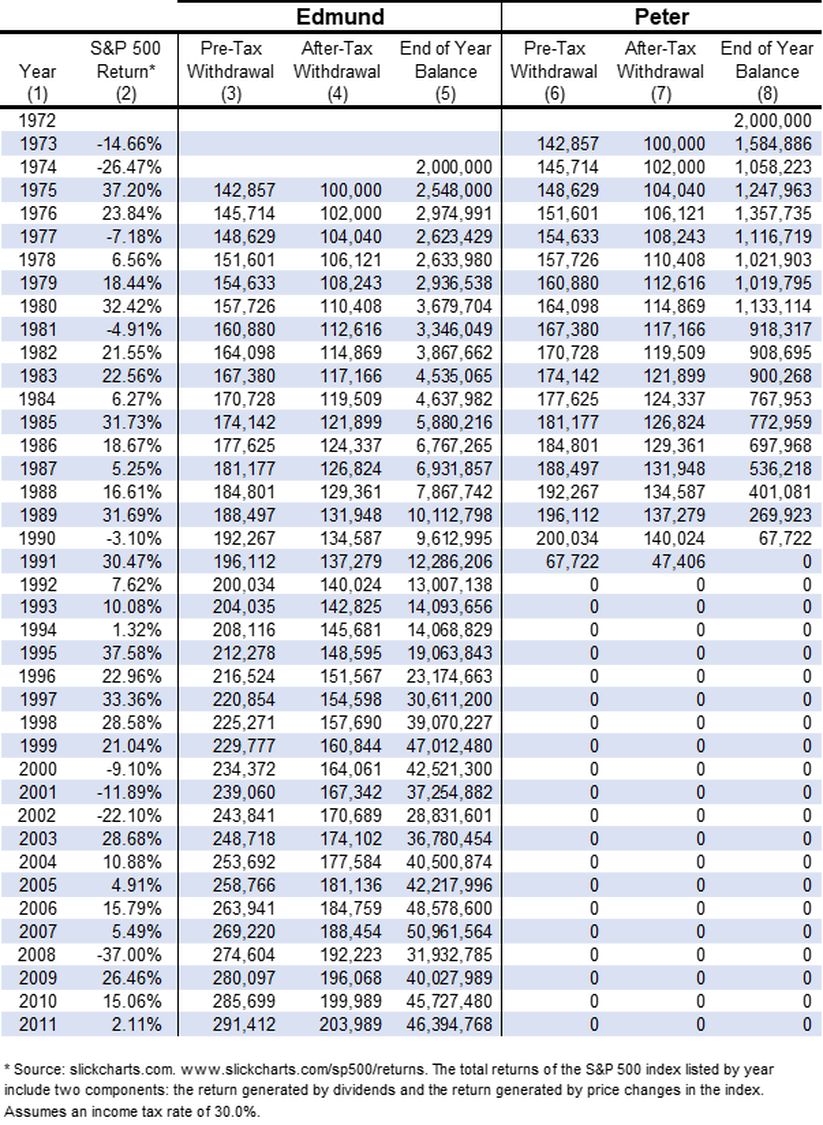

If you had a $2,000,000 nest egg, would it be enough to last through your retirement years? The answer can depend on... when you retire. What do I mean by that? Well, rather than a lengthy explanation, let me show you two hypothetical retirees: Peter and Edmund.

The only difference is that Peter retires in 1973 and Edmund retires in 1975. So what happens? Well, Peter runs out of money in year 19 at age 83. And Edmund? When does he run out of money? No, Edmund never does run out of money. In fact, his balance will be whopping $45 million+ when he’s 100. You don’t believe me? Check out the table below and see for yourself. So, as you can see, the timing of your retirement matters. A lot. More specifically, how your investment performs in the first few years of retirement matters a lot. Peter had a negative return in the year he retired. Plus, he withdrew money. So that was a double whammy. In fact, he had two negative years in a row. Ouch! And poor Peter never recovered from it. For Edmund, it was exactly the opposite. He had super good returns in the first two years of retirement. Again, the only difference here is that Peter retired two years earlier. That's it. That made all the difference. Big difference. It was literally a difference between having enough money through retirement and running out of money. Whoa hold on a sec, you say. No one in their right mind would put all their money in the S&P 500. You're right, but it doesn't matter. It makes little difference what you invest in. The point is, all things being equal, your investment portfolio’s performance in the first years of retirement can determine how long your money will last. The concept holds true regardless of what you're invested in. In hiking, ascending and descending require different techniques and preparations. It’s especially true with hardcore mountaineering. Descending is often considered much more involved and difficult than ascending. Likewise, spending in retirement is a whole lot different from saving for retirement. You need the right strategy and mindset to navigate through it to give yourself the best chance to make your money last. We do not provide legal or tax advice. Readers should consult their own legal or tax advisor. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular products, or services. You should note that you can’t actually invest in the S&P 500 index. You can buy an S&P 500 index fund and your return will be slightly different because of the fees associated with the management of the index fund.

Comments are closed.

|

AuthorElliott Bay Insurance Archives

July 2023

Categories

All

|

|

|