|

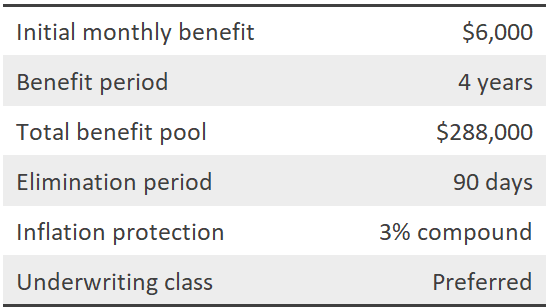

Have you (or your parents) reached an age that you’re curious about long-term care insurance? You want to know what it is, how it helps you, and what exactly is involved in applying for and getting coverage? Well, you’ve come to the right place. Let’s first outline basic features of a long-term care insurance policy. Now, let’s discuss these policy features in plain English:

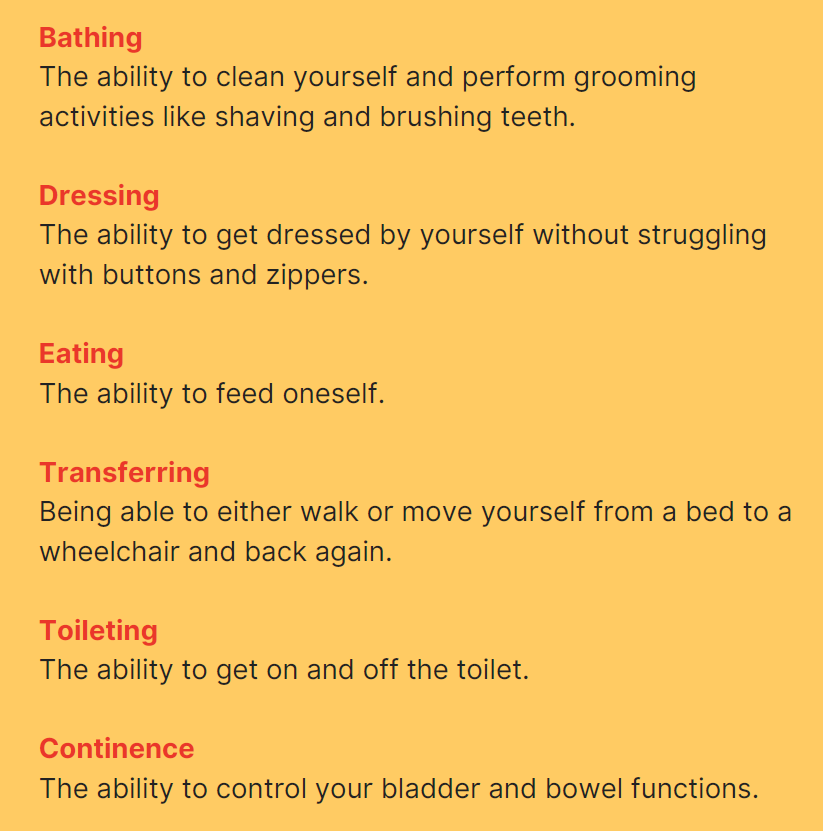

Your benefits generally trigger when you can’t perform 2 of 6 activities of daily living (ADLs) listed below: We hope this helped you get acquainted with some of the basics of long-term care insurance.

In our next installment, we’ll discuss pricing and alternative products to traditional long-term care insurance. Comments are closed.

|

AuthorElliott Bay Insurance Archives

July 2023

Categories

All

|

|

|